"This is the proposal that members of the college will be asked to adopt" on Wednesday, an European Commission official told Reuters.

BRUSSELS (Reuters) - The European Commission will consider a code of conduct asking sovereign wealth funds run by countries to stress commercial goals rather than strategic considerations when making investments, an EU official said.

"This is the proposal that members of the college will be asked to adopt" on Wednesday, an European Commission official told Reuters.

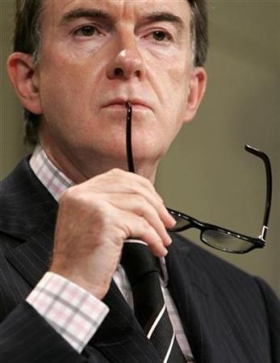

The Financial Times reported in Saturday's editions that European Trade Commissioner Peter Mandelson would offer the voluntary code, setting out standards for governance and transparency.

Sovereign wealth funds are pots of money held in another country's currency. They are current account surpluses that accumulate beyond what is needed for immediate purposes, so countries create sovereign funds to manage the extra resources.

!ADVERTISEMENT!China, Saudi Arabia, Singapore and Abu Dhabi are among the more than 20 countries which the International Monetary Fund says have such funds. The IMF estimates their worth somewhere between $2 trillion and $3 trillion, with the total potentially reaching $10 trillion by 2012.

The FT said the IMF is preparing guidelines similar to those to be offered by Mandelson.

Mandelson has in the past been reluctant to draw up rules governing the funds.

"If they respect the governance of those companies or institutions in which they're investing then I think that we can be fairly relaxed -- no less vigilant but fairly relaxed -- about how we approach any possible guidelines or regulations," he told Reuters in Davos last month.

He reiterated those views in his interview with the Financial Times.

"We should be positive, not paranoid, about the operations of sovereign wealth funds," Mandelson told the FT.

But he also said that if the funds refuse a voluntary code of conduct "pressure may grow for laws obliging them, at the least, to disclose their investments."

He said the Commission's action would try to demonstrate to the funds that Europe welcomed their investments.

Once the proposals are dealt with by the Commission they will be forwarded to the European Union's heads of state at a Brussels summit on March 13 and 14, the FT said.

(Reporting by William Schomberg and David Lawsky, writing by David Lawsky)