WASHINGTON (Reuters) - The Federal Reserve on Friday joined other U.S. banking regulators in backing new limits on certain billing practices by credit card companies.

By John Poirier

WASHINGTON (Reuters) - The Federal Reserve on Friday joined other U.S. banking regulators in backing new limits on certain billing practices by credit card companies.

The Fed approved a proposal that would generally prohibit credit card companies from increasing the annual percentage rate on a customer's outstanding balance. It would also ban companies from reaching back to prior billing cycles when calculating the amount of interest charges in the current cycle, a practice known as double-cycle billing.

The U.S. Office of Thrift Supervision and National Credit Union Administration already approved the same proposal. All three regulators said they hope to finalize the rule by the end of 2008.

!ADVERTISEMENT!Among the biggest issuers of Visa Inc <V.N> and MasterCard Inc <MA.N> credit cards are Bank of America Corp <BAC.N>, JPMorgan Chase & Co <JPM.N>, Citigroup Inc <C.N> <C.N>, Capital One Financial Corp <COF.N> and Discover Financial Services <DFS.N>.

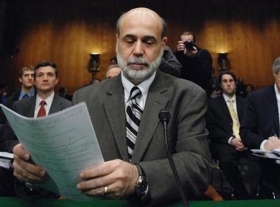

"The proposed rules are intended to establish a new baseline for fairness in how credit card plans operate," Fed Chairman Ben Bernanke said at a meeting to approve the proposal. "Consumers relying on credit cards should be better able to predict how their decisions and actions will affect their costs."

The banking industry has fought bills in the Senate and the House of Representatives that aim to limit similar practices.

"Regulatory responses such as these are effectively price controls, which have never worked in the past, and we do not believe they will work here," Edward Yingling, president of the American Bankers Association, said in a statement.

The new plan would also bar banks, thrifts and credit unions from assessing a fee for paying an overdraft on a checking account, debit card purchase or ATM withdrawal unless they give consumers the right to opt out of overdraft payments.

The proposals also attempt the halt the practice of raising interest rates on a balance when a cardholder fails to make payments on an unrelated bill. The proposal bars banks from changing rates on existing balances, but can tell customers 45 days in advance it might raise rates.

The public comment period for proposals aimed at addressing unfair and deceptive practices is 75 days and disclosure proposals for overdraft fees for consumers is 60 days.

Democrats in Congress said the proposals appear to tackle some practices, but more can be done but they are still an improvement from the current practices.

"It remains to be seen if these proposals will go far enough," said Senator Robert Menendez, a New Jersey Democrat.

In recent months, a number of U.S. lawmakers have criticized credit card billing and marketing policies that they say blindside unsuspecting cardholders who then become trapped by a mountain of exorbitant fees.

(Reporting by John Poirier, editing by Richard Chang)