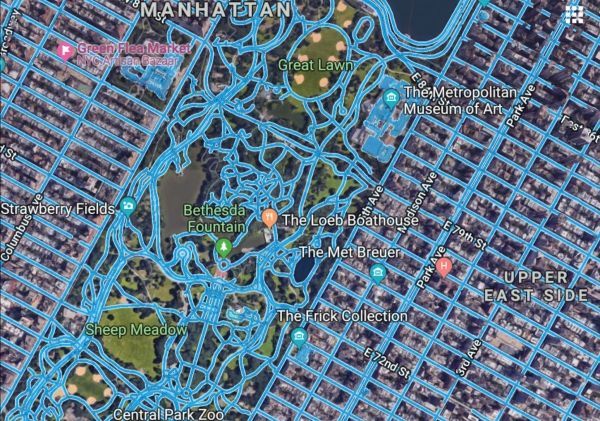

Map apps may have changed our world, but they still haven’t mapped all of it yet. Specifically, mapping roads can be difficult and tedious: Even after taking aerial images, companies still have to spend many hours manually tracing out roads. As a result, even companies like Google haven’t yet gotten around to mapping the vast majority of the more than 20 million miles of roads across the globe.

Gaps in maps are a problem, particularly for systems being developed for self-driving cars. To address the issue, researchers from MIT’s Computer Science and Artificial Intelligence Laboratory (CSAIL) have created RoadTracer, an automated method to build road maps that’s 45 percent more accurate than existing approaches.

>> Read the Full Article

The University of Waterloo launched the Waterloo Artificial Intelligence Institute today, bringing together a large group of researchers and businesses to advance technology and prepare Canada for future economic disruption.

Waterloo AI uniquely focuses on end-to-end innovation ranging from foundational to operational AI. Foundational AI advances the field as a whole through research in a number of areas, including statistical learning, deep learning, game theory and data science. Operational AI develops scalable, secure and transparent solutions for a wide range of applications.

>> Read the Full Article

Consider these three recent developments: California emerged from drought in April 2017, fewer companies reported impacts associated with water scarcity[1], and the average freshwater intensity of companies in the MSCI ACWI Index dropped by 15 percent between 2015 and 2016[2]. While these are positive short term signals for investors concerned with water scarcity, 2017 was also the most costly in U.S. history for natural disasters[3]. This underscored the thinking behind a key trend that MSCI ESG Research identified in the beginning of 2017[4]: institutional investors are shifting their portfolio analysis from the measurement of regulatory risks, such as the U.S. withdrawal from the Paris Agreement, to physical risks, such as exposure to coastal flooding along the U.S. Gulf Coast.

>> Read the Full Article

In 2014, I predicted “Desert Greening the Next Big Thing”,[1] would be led by green investors. I’m still waiting for this shift from humanity’s single minded focus on traditional agricultural crops (glycophytes) relying on the planet’s three percent of fresh water. Why so little shift to more sustainable, nutrient-richer, salt loving (halophyte) plant foods, such as quinoa? Because vested interests in the vast incumbent global agro-chemical industrial complex are as powerful and persistent as those in the worldwide fossilized sectors. Corporations like Cargill and ConAgra dominate, along with agro-chemical giants Monsanto, Syngenta, Bayer, BASF, and DowDupont, selling fertilizers, herbicides, insecticides, fungicides and genetically-modified seeds, as well as those selling farm machinery, Deere, Caterpillar, Yamaha and their thousands of dealers around the world.

>> Read the Full Article

ENN

Environmental News Network -- Know Your Environment

ENN

Environmental News Network -- Know Your Environment